Are you intrigued by the world of investing and looking to jump into the stock market? Whether you’re a seasoned trader or a beginner just starting out, learning the art of stock trading can be a challenging and rewarding experience. Because of this, we’ve made a set of fun, personalized courses to help you understand the stock market and reach your full potential as an investor. With our expert guidance, you’ll learn the ins and outs of trading, from understanding market trends to analyzing financial data and making informed investment decisions. So why wait? Join us on this exciting journey and take the first step towards achieving your financial goals today!

Contents

- 1 Is It Hard To Learn Stock Trading?

- 2 Things You Need To Know In Stock Trading

- 3 People Who Will Benefit From Taking Online Courses For Stock Trading

- 4 Top 5 Best Courses To Learn Stock Trading

- 4.1 ① The Complete Foundation Stock Trading Course

- 4.2 ② Stock Trading & Investing for Beginners 4-in-1 Course Bundle

- 4.3 ③ Day Trading & Momentum Strategies for the Stock Market

- 4.4 ④ Learn Stage Analysis – Stock Trading & Investing Method

- 4.5 ⑤ Stock Trading Momentum-Based Strategies (Technical Analysis)

- 5 Common Disciplines In Stock Trading

- 6 Tips To Become A Successful Stock Trader

- 7 Are Online Courses To Learn Stock Trading Worth It?

- 8 Final Words

Is It Hard To Learn Stock Trading?

Learning stock trading can seem intimidating at first, but it’s definitely doable with the right mindset and approach. It’s important to keep in mind that, like any other skill, it takes time, patience, and practice to become proficient at it.

One of the first steps to learning stock trading is to gain a basic understanding of the stock market and its terminology. This can be accomplished through reading books, taking online courses, or watching educational videos. Once you have a good grasp of the fundamentals, you can start exploring different trading strategies and techniques.

Importance of experimentation:

It’s important to note that there is no one-size-fits-all approach to stock trading. Every trader has his or her own unique style and preferences. Some prefer to focus on long-term investments, while others prefer short-term trades. Some traders rely heavily on technical analysis, while others use fundamental analysis. The key is to experiment and find what works best for you.

Another important aspect of learning stock trading is managing your emotions. Trading can be a rollercoaster ride of emotions, from the euphoria of making a profitable trade to the despair of losing one. It’s important to stay disciplined and not let your emotions cloud your judgment. This can be accomplished by developing a solid trading plan and sticking to it, even when things get tough.

Note:

Overall, learning stock trading may not be easy, but it’s definitely worth the effort. With dedication, patience, and a willingness to learn from both successes and failures, you can become a successful stock trader. Remember, the journey is just as important as the destination, so enjoy the learning process and have fun with it!

Things You Need To Know In Stock Trading

Stock trading can be a complex and dynamic process that requires a great deal of knowledge and skill. Here are some things you need to know in order to trade stocks effectively:

⦿ Fundamental Analysis

To trade stocks effectively, it’s important to analyze the financial health and performance of companies. This involves delving into key metrics such as earnings, revenues, and debt and using that information to determine whether a stock is undervalued or overvalued. By doing a thorough fundamental analysis, you can learn about a company’s strengths and weaknesses and decide if you want to buy its stock or not.

⦿ Technical Analysis

Technical analysis is another key aspect of successful stock trading. Technical analysis looks at charts and other indicators to find patterns and trends in stock prices instead of focusing on how well a company is doing financially. This analysis can help you make more informed decisions about when to buy or sell a stock, based on historical price movements and current market conditions.

⦿ Risk Management

Risk management is critical to successful stock trading. Setting stop-loss orders to limit possible losses and diversifying your portfolio to lower risk are two ways to do this. By managing risks in a strategic way, you can protect your investments and be less affected by changes in the market.

⦿ Market Knowledge

Staying informed about broader market trends and global events can also help you make informed trading decisions. By staying up-to-date on news and events that may impact the stock market, you can anticipate changes and adjust your trading strategy accordingly.

⦿ Brokerage Account

Opening a brokerage account with a reputable broker is essential to trading stocks. When choosing a broker, look for one that offers low commissions and fees, user-friendly trading platforms, and responsive customer service. This will help you make the most of your investments and avoid costly mistakes.

⦿ Patience

Successful stock trading requires patience and discipline. Rather than making impulsive decisions based on emotions or hunches, it’s important to take a measured approach to trade. By doing your research, analyzing the market, and waiting for the right opportunities, you can increase your chances of success over the long term.

⦿ Continuous Learning

Finally, the stock market is constantly changing and evolving. To stay ahead of the game, it’s important to stay informed and continuously learn about new developments in the market. By staying curious, asking questions, and seeking out new information, you can improve your trading skills and increase your chances of success.

People Who Will Benefit From Taking Online Courses For Stock Trading

✤ Beginners

Those who are new to the world of stock trading may find it daunting to navigate the complex world of financial markets. Courses can help them learn basic terms, trading strategies, market trends, and how to use technical analysis tools to make smart investment decisions. Beginners can gain confidence and a better understanding of the stock market by taking these courses. This will help them become better traders in the long run.

✤ Experienced traders

Even experienced traders can benefit from continuing education to stay on top of new trends, strategies, and technologies in the market. By taking advanced courses, experienced traders can learn about new trading techniques, such as algorithmic trading and machine learning, and gain an edge in the competitive world of stock and crypto trading. Courses can also help experienced traders improve their skills and get better results, which can lead to more money and success in the long run.

✤ Investors

Investors who want to learn how to make informed investment decisions can benefit from courses that cover fundamental analysis, technical analysis, and risk management. By taking these courses, investors can learn how to evaluate companies, analyze market trends, and manage their portfolios to reduce risk and increase returns.

They can also learn about different investment vehicles, such as stocks, bonds, and mutual funds, and gain a better understanding of how these vehicles work and how they can be used to achieve their investment goals.

✤ Professionals

Courses that give financial advisors, brokers, and portfolio managers specialized knowledge and skills can help their clients reach their investment goals. By taking these courses, professionals can learn more about the stock market and get better at things like allocating assets, planning for retirement, and managing taxes.

They can also learn about different investment products, such as ETFs and options, and gain a better understanding of how these products can be used to meet the needs of their clients. Ultimately, professionals who take these courses can provide better advice and guidance to their clients, which can lead to more satisfied and successful clients.

Top 5 Best Courses To Learn Stock Trading

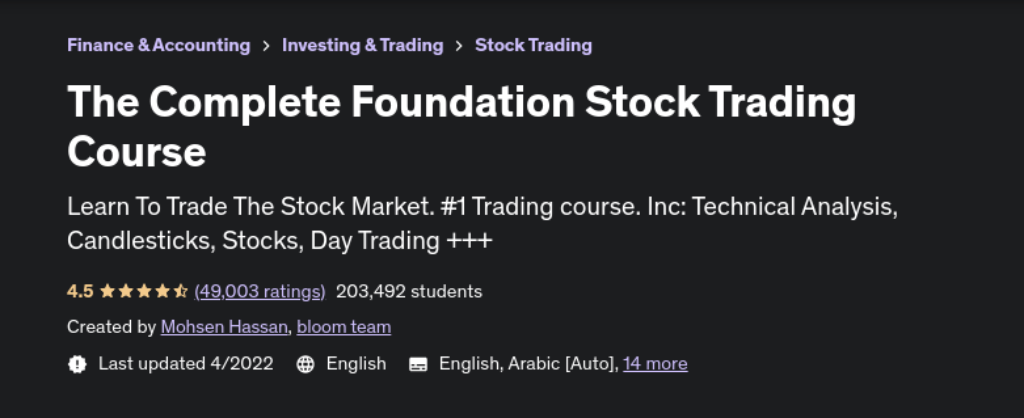

① The Complete Foundation Stock Trading Course

Course Description

Are you ready to unlock the mysteries of the stock market? In this course, you’ll embark on a journey to gain a comprehensive understanding of how it works, from the basics to the most intricate details.

You’ll delve into the process a company goes through to become a publicly traded company, explore the history of the stock market and its evolution, and master technical analysis. Through the eyes of professional traders, you’ll learn to filter out the noise, gain invaluable insight, and execute trades effectively.

From sending orders to different order types and exchanges to risk management, money management, short selling, and trading psychology, you’ll get a solid foundation for managing your portfolio well and becoming a successful trader.

Course Inclusion

- 9.5 hours VOD

- 32 downloadables

- Lifetime access

- TV and mobile compatibility

- Certificate of completion

About the Instructor

Allow me to introduce you to our brilliant instructor, Mohsen Hassan! Mohsen is very interested in both finance and computer science. He has spent years studying and working in the field, which has helped him learn a lot about the many different parts of the financial industry.

From long-term investing to shorter-term trading and automation, Mohsen’s expertise is unparalleled. He brings this wealth of knowledge to the table to teach others about the intricate workings of the financial markets and programming. As a testament to his passion for the field, Mohsen has founded Bloom Trading, where he can share his expertise with others and inspire the next generation of traders and investors!

② Stock Trading & Investing for Beginners 4-in-1 Course Bundle

Course Description

This course is designed to answer the most frequently asked questions by beginners and teach you everything you need to know to start trading and investing in the stock market. You’ll learn how to understand the financial statements of companies you want to invest in and analyze them using ratio analysis and common size analysis. You’ll also learn about activity ratios, liquidity ratios, solvency ratios, and financial ratios to make informed decisions.

This class will also teach you Benjamin Graham’s value investing strategy and how to use Graham’s Number to find stocks that are undervalued. Plus, you’ll get to apply technical analysis to stock trading and profit from a trade setup for all time frames and asset classes.

You’ll also learn about candlestick patterns applicable to all kinds of financial trading, including stock trading. Additionally, this course will teach you about gap trading and technical analysis concepts like support and resistance, trend lines, and trend channels. Finally, this course provides you with tips on money management to ensure that you’re trading and investing responsibly.

Course Inclusion

- 9 hours VOD

- 1 downloadable with 5 articles

- Lifetime access

- TV and mobile compatibility

- Certificate of completion

About the Instructor

Meet the experts at Indian Insight, a niche stock advisory and education firm dedicated to providing a top-notch education for retail investors just like you!

A group of seasoned professionals who run Indian Insight provides a wide range of courses for both novice and seasoned traders. Each course is meticulously designed with a focus on practical learning and hands-on experience, so you can put your newfound knowledge to work right away. Whether you’re looking to learn the basics or refine your skills, Indian Insight has got you covered.

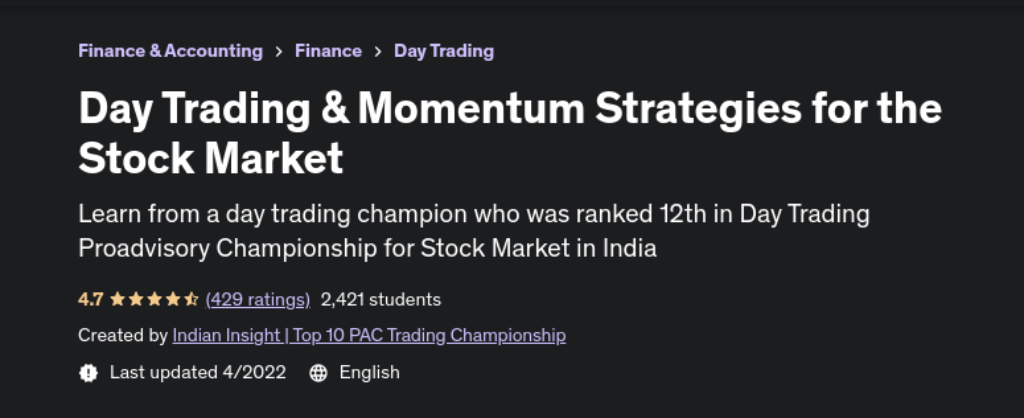

③ Day Trading & Momentum Strategies for the Stock Market

Course Description

Are you ready for this exciting course, where you’ll discover the ins and outs of day trading using two popular strategies? You’ll learn the tried-and-true EDC strategy and also explore a variation to spice things up. But that’s not all, because you’ll also get to manually back-test the historical performance of any trading strategy, which is a valuable skill to have as a trader.

In addition to the interesting material already mentioned, this course also has a section on the idea of moving averages. If you’re new to this concept, don’t worry, because this course has got you covered with clear explanations and practical examples.

After you finish this course, you’ll know everything there is to know about these popular day trading strategies and how to use manual back-testing to evaluate how well they work. This skillset will not only help you make a more informed trading decision but also give you a competitive edge in the market.

Course Inclusion

- 2.5 hours VOD

- 1 downloadable

- TV and mobile compatibility

- Lifetime access

- Certificate of completion

About the Instructor

Meet the amazing teacher behind Indian Insight, a stock advisory and education firm whose goal is to teach regular investors the best ways to trade and invest. This guru of the stock market has made it their mission to help students of all levels, from beginners to experienced traders, achieve their financial goals.

With a deep understanding of the ins and outs of the stock market, this instructor offers a wide range of courses that are tailor-made to meet the needs of each student. They know how important it is to learn by doing, so they work hard to make sure that each course is a rich experience that gives students useful skills and knowledge.

Whether you’re just starting out or looking to refine your existing trading strategies, this instructor’s passion and expertise will guide you toward success. With Indian Insight, you’re not just getting an education; you’re gaining a trusted mentor who is dedicated to your financial success.

④ Learn Stage Analysis – Stock Trading & Investing Method

Course Description

Picture yourself as a savvy investor, confidently navigating the ups and downs of the stock market with precision and skill. How do you do it? By mastering the Four Stages of Stan Weinstein’s Stage Analysis Method, a classic technical analysis technique that empowers you to buy and sell with confidence.

In this course, you’ll discover the insider secrets of the Stage Analysis Investor and Trader Methods, giving you the tools you need to know exactly when to enter and exit trades for maximum gains. You’ll learn how to identify the ideal Stage 2 entry points. This is the sweet spot where profit potential is at its highest and risk is at its lowest! And you’ll master the key components of the Stage Analysis Method, allowing you to uncover stocks with A+ potential and seize opportunities like a pro.

Whether you’re a seasoned investor or just starting out, this course will give you the skills and knowledge you need to take your portfolio to the next level.

Course Inclusion

- 3.5 hours VOD

- Lifetime access

- TV and mobile compatibility

- Certificate of completion

About the Instructor

Meet David, a seasoned investor and trading guru with over a decade of experience in the world of finance. Since 2007, he’s been honing his skills and perfecting his craft, mastering the art of buying and selling with precision and skill.

David’s secret weapon? Stan Weinstein’s Stage Analysis method! This is a classic technique that he’s used to great success in his own trading. But that’s not all! David is also well-versed in other popular methods like CAN SLIM and Mark Minervini, giving him a diverse range of tools and techniques to draw upon. However, at the heart of David’s success is his deep understanding of the Stage Analysis method. It’s been the basis of his successful trading for years, letting him find stocks with high potential and trade at the right time.

With David as your instructor, you’ll learn from a true master of the craft. He’s someone who’s been in the trenches and knows exactly what it takes to succeed in the world of trading and investing.

⑤ Stock Trading Momentum-Based Strategies (Technical Analysis)

Course Description

Are you ready to become a stock market ninja? In this course, you’ll learn how to harness the power of momentum and use it to your advantage in your trades. You’ll be given a complete trading system that you can build from the ground up and customize to your liking. From basic concepts to advanced strategies, you’ll be fully immersed in the world of RSI, William R, Stoch, MFI, and RSI indicators, learning how to use them like a pro in different trading markets. With this arsenal of knowledge, you’ll be equipped to tackle any challenge the market throws your way, confidently navigating through the twists and turns of the financial world.

Course Inclusion

- 10.5 hours VOD

- Lifetime access

- Assignments and articles

- TV and mobile compatibility

- Certificate of completion

About the Instructor

Let me introduce you to the financial guru behind this course – the mastermind behind Oedtech, who’s dedicated to sharing the secrets of making and saving money with traders all over the world. Unlike other online courses that merely teach you theory, this instructor’s approach is all about practicality. He’s a firm believer in learning by doing. With years of experience under his belt, he knows exactly what it takes to succeed in the world of trading and investing, and he’s passionate about passing on his wisdom to students like you.

Common Disciplines In Stock Trading

✦ Money Management

Traders should have a plan for how much they are willing to risk per trade and how much they are willing to allocate to their trading account. They should also have a plan for when to take profits and when to cut losses.

✦ Emotional Control

Emotions can often cloud a trader’s judgment and lead to impulsive decisions. Successful traders have emotional control and are able to remain calm and level-headed, even during volatile market conditions.

✦ Flexibility

The stock market is constantly changing, and successful traders must be able to adapt to new market conditions and adjust their trading strategies accordingly.

✦ Time Management

Trading requires a significant amount of time and attention. Successful traders know how to use their time well and put things in order of importance so they can make the most of their trading opportunities.

✦ Networking

Making connections with other traders and industry professionals can help you learn new things and find ways to work together. Successful traders often join online trading communities, go to conferences, and talk to other traders on social media.

✦ Record Keeping

Keeping a detailed record of your trades can help you find patterns, evaluate your performance, and make changes to your trading strategy.

Tips To Become A Successful Stock Trader

✓ Read and research

Keep yourself updated with the latest financial news and trends. By reading books, financial news websites, and research reports, you’ll be able to gain a deeper understanding of how the stock market works, and this can help you make better investment decisions. Engage with the content, ask questions, and seek out experts in the field to learn from them.

✓ Practice with a demo account

Practice makes perfect, and this is especially true when it comes to trading stocks. Before you start investing real money, practice trading with a demo account. This will allow you to hone your trading skills and strategies without putting your hard-earned money at risk. Try different techniques, test out new ideas, and learn from your experiences.

✓ Develop a trading plan

A trading plan is an essential tool for every successful trader. It’s a set of rules and guidelines that you follow when trading stocks, and it should include your goals, risk tolerance, and strategies for entering and exiting trades. Take time to reflect on your personal goals, analyze the market, and make a plan that fits your lifestyle and financial objectives.

✓ Manage risk

Risk management is critical when it comes to trading stocks. Successful traders manage their risk by using stop-loss orders and diversifying their portfolios. Never invest more than you can afford to lose, and make sure to set realistic expectations for your returns. Stay vigilant and adjust your strategies to manage risk in different market conditions.

✓ Be disciplined

Discipline is the key to successful trading. Stick to your trading plan and don’t let emotions guide your decisions. Keep your head cool and make rational choices based on the data and analysis you’ve done. Don’t give in to FOMO, and don’t let losses get you down. Keep learning and adapting, and always stay focused on your goals.

✓ Learn from your mistakes

No trader is perfect, and you will make mistakes along the way. The key to success is to learn from your mistakes and adjust your trading plan accordingly. Analyze your trades, reflect on your decisions, and seek feedback from other traders. Remember that mistakes are opportunities to learn and grow as a trader.

✓ Network with other traders

Trading can be a lonely profession, but it doesn’t have to be. Join online trading communities or attend trading events to network with other traders. This can help you learn new strategies and stay motivated. Build relationships, share ideas, and collaborate with other traders to create a supportive and dynamic trading community.

Are Online Courses To Learn Stock Trading Worth It?

Absolutely! Online courses can be a great way to learn about stock trading, whether you’re a complete beginner or already have some knowledge of the markets.

✲ Convenience factor

First of all, let’s talk about the convenience factor. Online courses allow you to learn from the comfort of your own home, at your own pace. You don’t have to worry about commuting to a physical location or scheduling conflicts with work or other commitments. Plus, many online courses offer lifetime access to the course material, so you can refer back to it whenever you need a refresher.

✲ Credible instructors

But it’s not just about convenience. Online courses also offer a wealth of information and resources that can help you become a better trader. Professionals with years of experience in the field teach a variety of courses. They can give you valuable information about the markets and tips on how to trade successfully.

✲ Interactive classes

Also, online courses often have interactive parts like quizzes, exercises, and simulations of live trading. These can help you put your knowledge into practice and get feedback on your progress. Plus, you can interact with other students in the course, ask questions, and share ideas and experiences.

✲ Proof through reviews

Of course, it’s important to choose the right online course for your needs. Look for courses that are taught by reputable instructors and have a proven track record of success. Check out reviews from other students and make sure the course covers the topics you’re interested in.

In short, online courses can be a valuable tool for learning stock trading. They are easy to use, come with instructions from experts, and have interactive features that can help you become a better trader. So why not give it a try? Who knows? You might just discover a new passion and a new source of income!

Final Words

And that’s a wrap on our discussion about the best courses to learn stock trading! By now, you should have a clear idea of the different courses available, what they offer, and how they can benefit you on your trading journey.

Whether you’re a complete beginner or an experienced trader looking to sharpen your skills, there’s a course out there that’s perfect for you. There are a lot of ways to learn how to trade stocks successfully, from in-depth online classes to one-on-one coaching sessions.

But remember, learning about stock trading is just the first step. It takes patience, discipline, and a willingness to learn from your mistakes to truly succeed in this challenging but rewarding field. So take what you’ve learned here, put it into practice, and never stop striving for improvement. Happy trading!

We are committed to providing our users with unbiased and honest reviews of various courses to help them make informed decisions about their education. Our career roadmaps are tailored to specific industries, providing a clear path to success in various fields.

In addition to our course reviews and career roadmaps, we offer a wealth of articles covering a range of career-related topics, from resume writing to interview tips to workplace culture.

At coursetry.com, our mission is to empower individuals with the knowledge and resources needed to advance their careers and achieve their goals. Our platform is constantly evolving and expanding to better serve our users, and we are dedicated to providing the best possible experience for everyone who visits our site.